Pay-Term Optimization

Pay-Term Optimization

Pay-Term Optimization (PTO) is a unique solution to the cash flow and credit risk tension between refiners, wholesalers, and fuel buyers. Program suppliers get paid as fast as Net 1 by U.S. Bank , while buyers receive extended terms of up to 75 days. U.S. Bank assumes 100% of the credit risk. Program fees are highly competitive and though typically paid by the buyer, they can be paid by the supplier or even split between both. Not to be confused with factoring programs, PTO is true payments innovation for the bulk fuel supply chain.

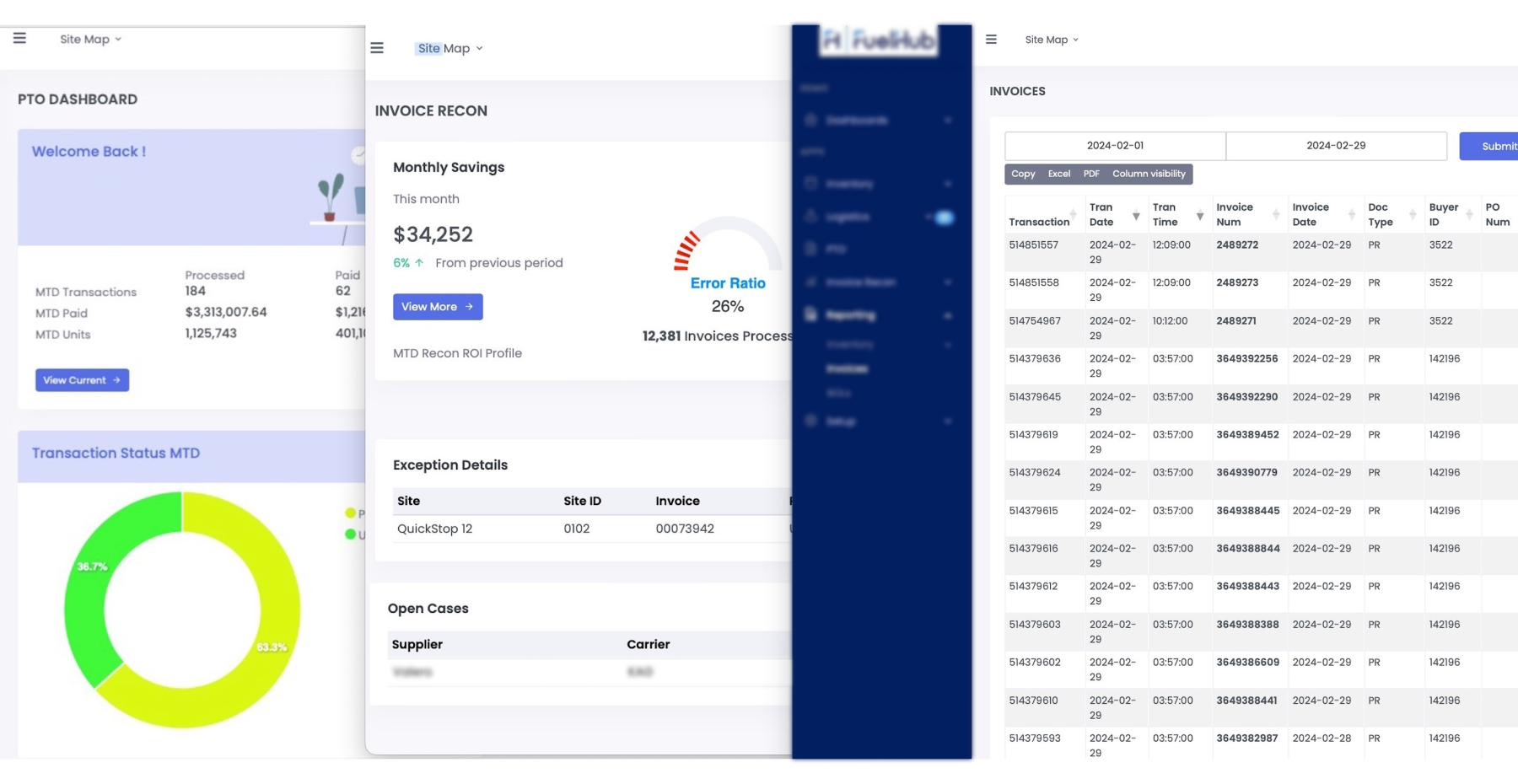

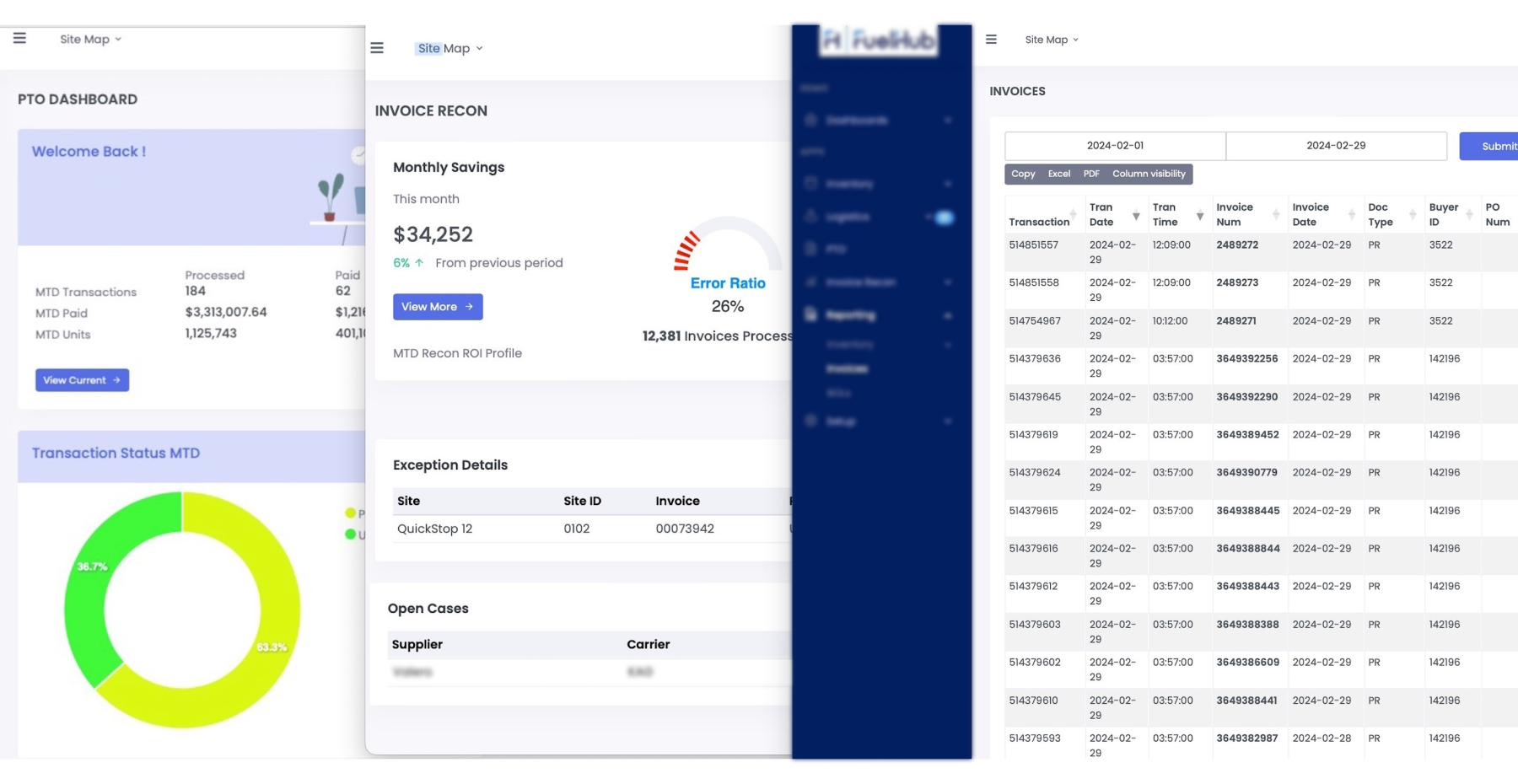

Our Technology

Our cloud-based platform provides a real-time dashboard and control center for managing invoices associated with the program. With a quick implementation time frame of as little as two weeks and no IT impact to customers or suppliers, we make optimizing cash-flow a breeze. Customers can optimize their entire portfolio of invoices or utilize our platform to select which invoices they want processed and paid by U.S. Bank.

Benefits to Fuel Suppliers

Credit Risk Removal

100% of credit exposure is removed from Refiner and Supplier financials.

Time Value of Money

Realize revenue as fast as net 1.

Increased Volume Throughput

Gain access to our eco-system of fuel buyers.

Benefits to Fuel Buyers

Optimized Supply Chain

Leverage PTO to increase supply options, generate more competitive pricing, and simplify vendor admin.

Extended Pay Terms

Extend your fuel invoice pay terms up to 75 days and improve cash flow.

Invoice Reconciliation

Reduce overhead and accounting burden with our optional invoice reconciliation service.

Get in Touch with Us

Ready to take the next step?

Contact our team today to discuss how we can tailor our solutions to meet your specific needs. We’re here to answer any questions and help you fuel success!

1-833-FUELHUB (383-5482)

info@fuelhubservices.com

![]() www.fuelhubservices.com

www.fuelhubservices.com

Start Saving Now

Once you send us your contact information, our team will get back to you within 1 business day.